INCOME TAX

Income tax (IRPF) requires tax residents in Spain to declare all income earned worldwide in the calendar year, from January 1 to December 31.

The filing period normally begins in mid-April and ends at the end of June.

The tax result is obtained by applying the income to two different progressive tax scales depending on the type of income:

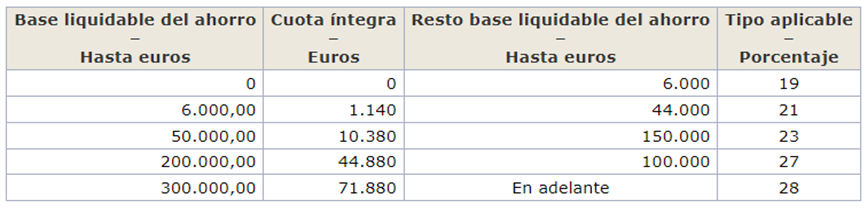

- Savings scale

- General scale

In the savings scale, dividends, interest and capital gains obtained from the sale of properties are subject to taxation.

SAVINGS SCALE

In the general scale of the tax, everything that is not part of the savings scale is subject to taxation, i.e., income from work, pensions, economic activities, property rental, etc.

The IRPF is a tax that is shared with the 17 different regions that form the Kingdom of Spain, which means that the general scale is divided in 2, a part established by the State, the same for all, and another part regulated by these regions with a variability depending on which region you are established in.

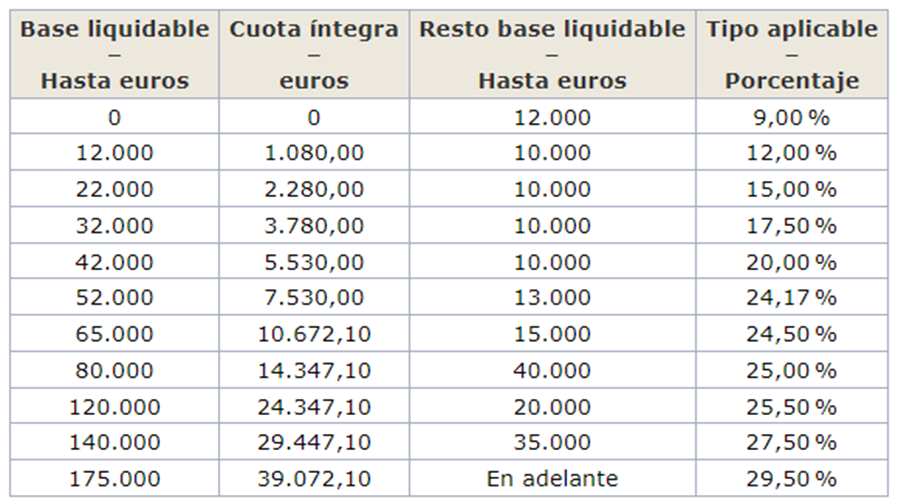

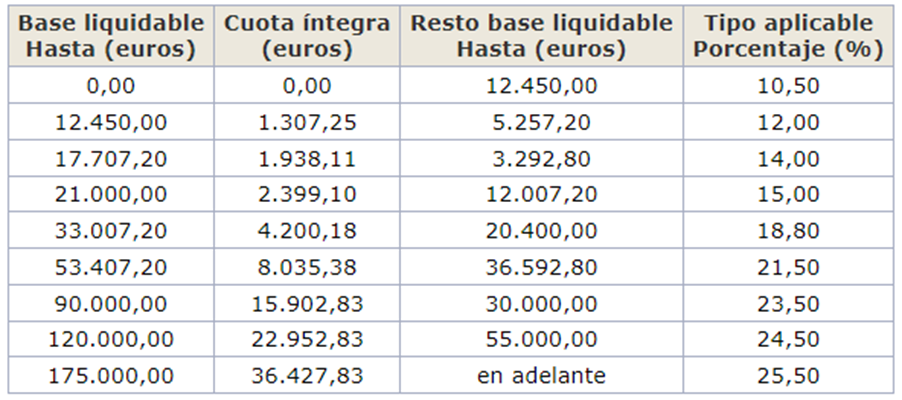

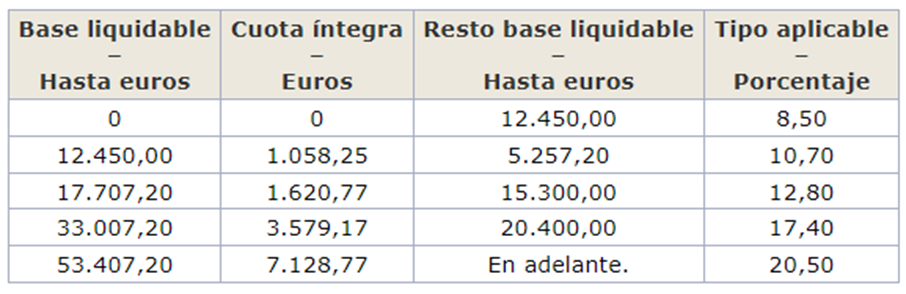

For example, below you can see the general state scale and the scales of the Valencian Community, Catalonia and Madrid.

STATE GENERAL SCALE

COMUNIDAD VALENCIANA SCALE

CATALUÑA SCALE

MADRID SCALE

As for deductions, these would be the main ones:

- Personal minimum of 5,550 euros. From 65 years of age 6,700 euros and from 75 years of age 8,100 euros.

- General deduction of 2,000 euros for obtaining income from work or pensions.

- Reduction of 6,498 euros for income from work or pensions of less than 14,047.50 euros. This reduction decreases progressively by applying a mathematical formula for taxpayers with income between 14,047.50 euros and 19,747.50 euros.

- Deduction of 3,400 euros for joint declaration between spouses (The joint declaration in Spain is only interesting when one of the spouses has an income of less than 3,400 euros).

Let’s see an example of a 70 year old taxpayer living in the Valencian Community and receiving an annual pension of 40,000 euros:

1) In the first step we apply the general deduction 40,000 – 2,000 = 38,000 euros. This is the taxable base.

2) We apply the base to the general state and Valencian Community scale

A) State tax: (38.000 – 35.200) x 18,50% + 4.362,75 euros = 4.880,75 euros

B) Valencian Community tax: (38.000 – 32.000) x 17,50% + 3.780 euros = 4.830 euros

3) We apply the personal minimum (6,700 euros in this case) to the lower part of the general state and Valencian Community scale.

C) State personal minimum: 6,700 x 9.50% = 636.50 euros

D) Valencian Community personal minimum 6.700 x 9% = 603 euros

The final result is obtained by adding A and B and subtracting C and D = 4,880.75 + 4,830 – 636.50 – 603 = 8,471.25 euros of tax in Valencia region.

If the taxpayer live in Catalonia the result would be 8,679.58 euros of tax.

And if the taxpayer live in Madrid the result would be 8,122.67 euros of tax.